All Categories

Featured

Table of Contents

[/image][=video]

[/video]

If you want to become your own bank, you have actually come to the ideal area. First, do you recognize how financial institutions take care of to be the richest establishments in the world? Do you believe the financial institution is going to sit on that cash?

Did you know that financial institutions gain between 500% and 1800% greater than you? If the financial institutions can primarily relocate money and gain rate of interest that way, wouldn't you like to do the same? We would certainly! Actually,. We've produced our individual financial system, and we're even more than pleased to reveal you how to do the very same.

Nelson Nash was fighting with high rate of interest on commercial small business loan, yet he effectively did away with them and began educating others how to do the same. One of our favorite quotes from him is: "The really first principle that needs to be comprehended is that you fund every little thing you buyyou either pay rate of interest to somebody else or you give up the passion you might have gained or else." Prior to we explain this process, we intend to make sure you recognize that this is not a sprint; it's a marathon.

Bank On Yourself Plan

A whole life insurance policy is a kind of irreversible life insurance policy, as it offers life coverage as long as you pay the costs. The initial distinction compared to term insurance policy is the period. That's not all. Another difference between term insurance coverage and entire life is the cash worth.

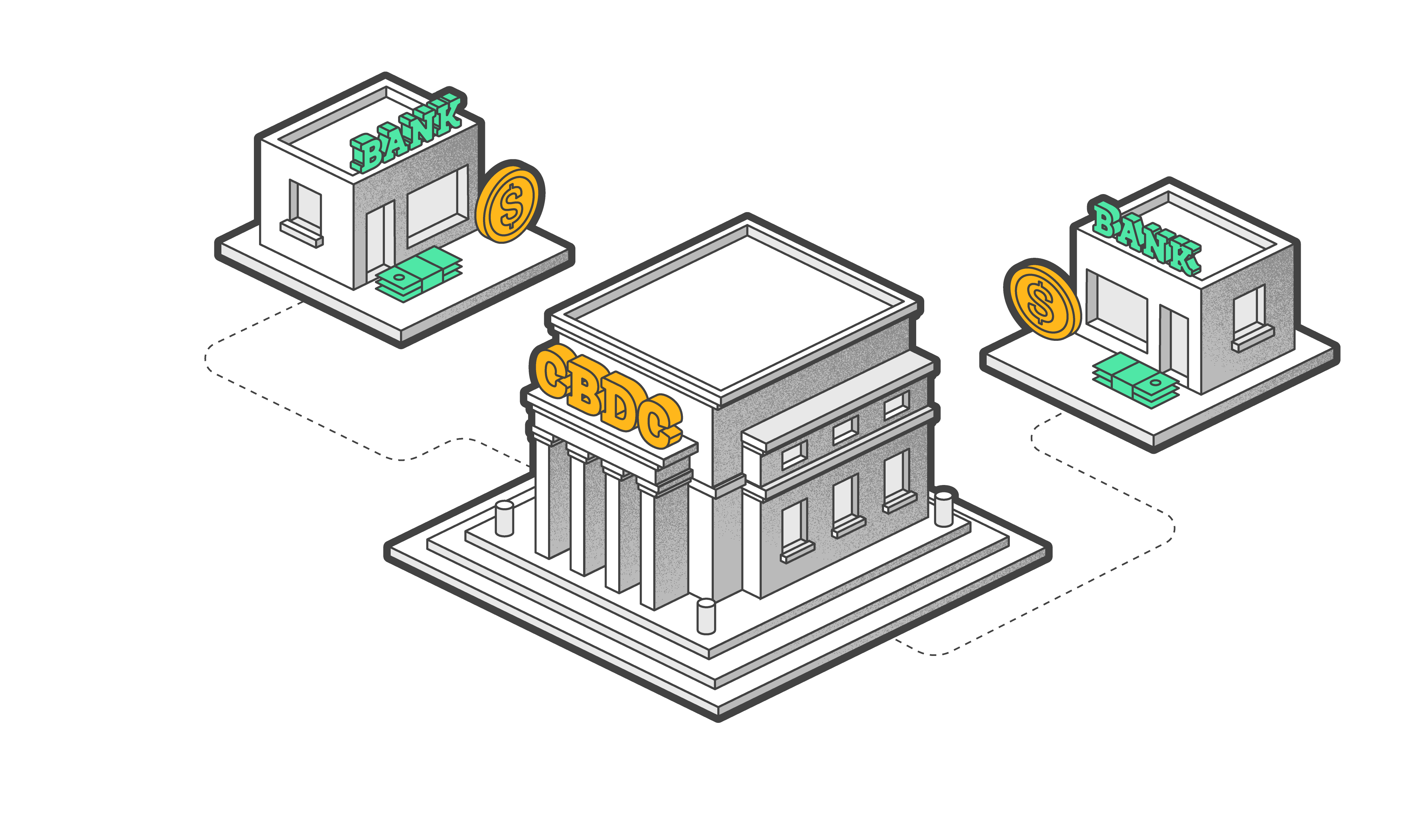

As we saw, in the typical banking system, you have an interest-bearing account where you transfer your money, which will earn interest. But the problem is, we do not obtain wealthierthe financial institutions do. Given that we desire to duplicate the process of conventional financial, we require an interest-bearing account that is autonomous.

You acquire the entire life insurance plan from the insurance company in the same method that you would certainly any various other policy. It will require a clinical exam. Even if you have some health and wellness concerns, don't worry. It is possible to purchase a plan on someone near to you to act as your very own financial institution.

Infinite Banking Concept Wiki

Your plan needs to be structured properly in order to become your own banker. As you possibly know, insurance coverage have month-to-month premiums you need to cover. With an entire life, that quantity is guaranteed for your whole life. Nonetheless, since we wish to utilize the entire life policy for personal financial resources, we need to treat it in a different way.

To put it simply, these overfunding repayments become promptly easily accessible inside your personal family members bank. The of this extra repayment is invested in a little section of added irreversible fatality advantages (called a Paid-Up Addition or PUA). What's remarkable is that PUAs will no more require superior settlements since it has been contractually paid up with this one-time payment.

Your cash money well worth is increased by these Paid-Up Additions, which contractually begin to increase at a (also if no returns were ever paid again). The thinking coincides as in traditional financial. Financial institutions need our cash in interest-bearing accounts to get affluent, and we require our money in our interest-bearing accounts on steroids (whole life insurance plan) to begin our individual banking method and get rich.

We desire to imitate that. When your cash worth has built up, it's time to start using it. And here is the part of this process that needs creativity. There are 4 different means to utilize your policy, yet in this post, we will certainly cover only obtaining. You should not switch on the traffic signal simply because you saw words loaning.

You don't need to wait for authorization or stress over rejection.: When you take loans, none of your money worth ever before leaves your whole life insurance coverage plan! Your overall cash money worth equilibrium, including the sum you borrowed, keeps raising. The following action in the process of becoming your own banker is to pay back the policy financing.

Bank On Yourself Strategy

Plan fundings do not show up on credit rating reports since they are a personal agreement between you and the insurer. There's even a lot more. You have. You set up when you pay rate of interest and concepts. You can make interest-only payments. You do not require to pay anything till you can make a balloon payment for the overall sum.

Nothing else company provides this level of liberty to work as your very own bank. You can prepare some kind of repeating lending upkeep, but the insurance agents do not require it. We did state that this is a four-step guide, yet there is one extra action that we want to point out.

And the best component is that you don't have any restrictions on the number of times you will certainly duplicate this process. That's why the procedure of becoming your own banker is likewise called. There are unlimited opportunities for how you can use your very own financial institution. If you still have some doubts, let's see the difference between your individual financial institution and a standard one.

You will never have to pay interest, high charges, or penalties to anyone. Financial flexibility. You can utilize your family financial institution for covering any cost.

Boundless financial is the only method to really fund your way of living the means you desire it. That's why here at Wealth Country we like the term Way of life Banking. Exists anything else that you would certainly need to be your own financial institution? Maybe somebody specialist and trustworthy that can instruct you all the nitty-gritty information of establishing your own financial system.

Picture a world where people have no control over their lives and are constrained to systems that leave them helpless. Photo a world without self-sovereignty the ability to take control of one's funds and destiny.

Can You Be Your Own Bank

The concept of self-sovereignty empowers people to make their very own choices without undergoing the control of powerful central authorities. This idea has actually been around for fairly a long time. Self-sovereignty implies that every individual has the power and liberty to make their very own decisions without being controlled by others.

When you put your cash in a bank, you partially shed control of it. It comes to be the financial institution's money to do as they see fit, and only a portion is guaranteed.

These wallets provide you single accessibility to your funds, which are shielded by an exclusive secret just you can manage. You can also access your cash anytime, no matter of what happens to the company that made the pocketbook.

If it goes bankrupt, you might lose your coins with little hope of obtaining them back. If you make use of a non-custodial purse and maintain your exclusive essential safe, this can not occur. Your money is kept on the blockchain, and you save the exclusive tricks. Find out more regarding why you should not keep your assets on exchanges.

Infinite Banking 101

If you keep it in a non-custodial budget, there is no danger of a bank run or a hacking attack. There is less chance of anyone requiring the budget proprietor to do anything they don't want to do.

Latest Posts

The Concept Of Becoming Your Own Bank

Private Family Banking Life Insurance

Create Your Own Banking System